What crucial nine- or eight-digit identifier facilitates seamless funds transfer?

A nine- or eight-digit number, often found on checks and bank documents, is a crucial component of the U.S. Automated Clearing House (ACH) system. This unique identifier designates a specific financial institution and facilitates the processing of electronic transactions, such as direct deposits and payments. For instance, a payment to a company's account will include the company's account number and this number to direct the funds from one institution to another.

This identifier is vital for the smooth operation of the financial system. It ensures that funds are routed correctly to the intended recipient's account, minimizing errors and delays. The standardization of this process, along with the corresponding infrastructure, reduces transaction times and costs compared to traditional paper-based systems. This standardized system allows for faster and more efficient financial transactions. Its historical significance lies in its ability to automate the transfer of funds. Previously, each financial institution maintained a separate, often cumbersome, system of handling these transfers. This identifier, by providing a common framework, revolutionized the industry, creating efficiencies and enabling the widespread use of electronic payments.

Further exploration of this identifier's role in different payment systems, including international transfers, and its impact on the global economy could provide a more in-depth understanding of its significance in financial transactions.

Routing Transit Number

The Routing Transit Number (RTN) is a critical component of financial transactions, facilitating the efficient transfer of funds between financial institutions. Understanding its key aspects provides insight into the underlying infrastructure of electronic payments.

- Identification

- Bank location

- Transaction routing

- ACH network

- Payment processing

- Error prevention

- Automated transfer

The RTN's function as a unique identifier for banks allows for seamless routing of transactions. Coupled with account numbers, it directs funds to the correct institution. Its use within the Automated Clearing House (ACH) network is crucial for swift processing of electronic payments. Error rates are minimized by precise routing based on this identifier. This efficiency is further enhanced through automation, where funds are transferred directly and automatically. The RTN's presence in check processing systems further highlights its historical importance in handling payments. In modern financial systems, the RTN's reliability ensures that payments are accurately processed and reach their designated recipients, underpinning the smooth functioning of the financial system.

1. Identification

A Routing Transit Number (RTN) fundamentally serves as a unique identifier for financial institutions. This identification process is paramount for accurate and efficient routing of financial transactions. Without a reliable method for distinguishing between institutions, the electronic transfer of funds would be severely hampered, leading to confusion, delays, and potential fraud.

- Uniqueness and Distinctiveness

The RTN's core function is to ensure each bank is distinguished from every other. This uniqueness allows payment systems to correctly route funds. The RTN is akin to a social security number for financial institutions, ensuring that payments are directed to the correct entity. For instance, a payment to Bank A requires the RTN for Bank A to ensure the funds reach the designated account.

- Linking to Accounts and Locations

An RTN is inextricably linked to a specific banking institution's location and operations. This association is critical for processing payments efficiently. By identifying the originating bank, the payment system can determine the most appropriate routing path for the funds.

- Account-Level Processing

While the RTN designates the institution, it does not directly identify individual accounts. An RTN paired with an account number is necessary to process payments successfully. The combination of both ensures that funds are routed to the correct account within the designated institution. This two-part identifier system is essential for accuracy in the ACH network.

- Security and Risk Management

The unique nature of RTNs is integral to security measures. By precisely identifying the bank to which a payment is sent, the system can prevent misdirected funds, a crucial step in protecting financial assets. This stringent identification process minimizes the risk of unauthorized or fraudulent activity within the electronic payment system.

In summary, the identification aspect of an RTN is critical. It is fundamental to all financial transactions processed within the Automated Clearing House (ACH) network and essential to the safety and reliability of electronic payments. The RTN's inherent characteristics of uniqueness and unambiguous links to institutions ensure efficient processing, reducing risk and safeguarding funds.

2. Bank location

A Routing Transit Number (RTN) is intrinsically linked to a bank's physical location. This connection is fundamental to the functionality of the U.S. Automated Clearing House (ACH) network. The RTN directly identifies the specific financial institution responsible for handling payments and ensuring funds reach the designated recipient's account. This association is crucial for routing and processing transactions accurately. A bank's location, as reflected in its RTN, dictates the regional payment processing network to which it belongs. This localization ensures transactions are handled within established geographic parameters and optimizes processing efficiency by using established regional hubs for processing. For example, a payment routed through a New York-based bank will utilize different processing centers and networks than a payment routed through a California-based bank.

The correspondence between bank location and RTN is a cornerstone of the financial system's structure. It enables efficient routing, minimizing delays and ensuring payments arrive at the intended destination. The system's reliance on this correlation facilitates secure and reliable fund transfers across different financial institutions. The geographic aspect also influences the processing speed and effectiveness. The location's infrastructure plays a crucial role in the RTN's ability to effectively support electronic payment. The geographic location influences the speed of processing based on location and infrastructure, as each RTN will correspond to regional processing centers. This inherent relationship, therefore, underscores the critical nature of accurate geographic data in the context of financial transactions.

In summary, a bank's location is a vital component of its RTN. This association, coupled with the system's inherent geographic considerations, guarantees accurate routing and optimized transaction processing within the ACH network. Understanding this linkage is crucial for navigating and comprehending the mechanisms of modern electronic payments. The precise identification and routing facilitated by this connection play a significant role in maintaining the integrity and reliability of financial transactions.

3. Transaction Routing

Transaction routing, a critical aspect of electronic fund transfers, hinges on the Routing Transit Number (RTN). The RTN acts as the key to directing funds to the appropriate financial institution. This process begins with a transaction originating from one institution. The financial institution issuing the payment uses the RTN of the recipient's bank to identify the correct destination. This identification allows the initiating bank's system to route the transaction through the appropriate channels, ultimately enabling the funds to reach the designated account. The RTN, therefore, is an indispensable component of the transaction routing process. Precise routing is essential to prevent errors and ensure funds reach the correct account, facilitating smooth and reliable financial transactions. In practice, the RTN is a critical step in a sequence of actions, guiding payments through various levels of processing and security checks within the Automated Clearing House (ACH) network.

Accurate transaction routing is crucial in preventing delays and errors. If the RTN is incorrect or absent, the transaction may be rejected or routed to an incorrect institution, leading to significant disruptions. For instance, a direct deposit for payroll might fail if the RTN associated with the recipient's bank is mismatched. The correct RTN directs the funds toward the intended recipient's account, enabling timely processing. Without proper transaction routing, funds could become misdirected or lost, leading to financial setbacks for the payee and potential disruptions in business operations. The consequences of incorrect routing can be substantial and impact individual finances and corporate operations alike. Furthermore, inaccurate routing can expose systems to risks associated with fraudulent activity. The accuracy of RTNs ensures the integrity of electronic payments.

In conclusion, transaction routing is fundamentally dependent on the Routing Transit Number. The RTN provides the mechanism for directing funds to the correct financial institution, enabling secure and efficient electronic fund transfers. Accurate routing, facilitated by the RTN, is essential for preventing errors and delays, protecting financial assets, and maintaining the overall integrity of the financial system. Understanding this intricate connection between transaction routing and RTNs is vital for navigating the complex landscape of modern electronic payments.

4. ACH Network

The Automated Clearing House (ACH) network is a critical component of the U.S. financial infrastructure, facilitating electronic payments. A fundamental aspect of this network is the Routing Transit Number (RTN). The RTN acts as a vital link within the ACH network, enabling the precise routing of transactions. Without the RTN, the ACH network's efficiency and reliability would be severely compromised. The RTN uniquely identifies a financial institution, allowing the network to direct payments to the correct destination. This crucial link ensures funds reach their intended account at the designated institution. For instance, a direct deposit to an employee's account necessitates accurate routing, accomplished through the RTN associated with the employee's bank.

The RTN's role in the ACH network is fundamental to its operation. It enables the network to efficiently process a vast volume of transactions, supporting various payment types, including direct deposits, bill payments, and corporate transfers. The RTN's precision in identifying institutions ensures swift processing and minimizes errors. This precision is crucial, especially in high-volume transactions like payroll processing or government benefits distributions. Failures in routing due to incorrect RTNs could result in significant delays or financial losses. The network's success relies heavily on the accuracy and validity of RTNs. The ACH network's ability to handle large transaction volumes and the associated costs is deeply interwoven with the efficient use and processing of the RTNs.

In conclusion, the ACH network and the Routing Transit Number are inextricably linked. The RTN is essential for the network's functionality, enabling accurate transaction routing. Understanding this connection is vital for appreciating the reliability and efficiency of electronic payments in the U.S. financial system. The precise and consistent application of the RTN within the network is a cornerstone for security, efficiency, and the overall stability of the financial ecosystem. Failure to recognize this connection could lead to significant disruptions in financial operations.

5. Payment processing

Payment processing is a multifaceted operation crucial to modern finance. A critical component of this process is the Routing Transit Number (RTN). The RTN plays a definitive role in facilitating the efficient and accurate transfer of funds between financial institutions, directly impacting the success of any payment system.

- Identification and Validation

The RTN is fundamental to payment processing. It acts as a unique identifier for banks and financial institutions. Before a payment can be processed, the receiving institution's RTN must be validated. This validation verifies the legitimacy of the recipient. This step, enabled by the RTN, helps prevent funds from being sent to fraudulent accounts, thereby protecting financial interests. Correct RTN identification is critical to ensuring funds arrive at the intended destination.

- Routing and Transfer Efficiency

The RTN directly governs the routing of payments within the financial system. The system utilizes the RTN to determine the most appropriate transfer pathways. This optimization minimizes delays and ensures that payments reach the destination in a timely and efficient manner. Without this function, payments might be misrouted or delayed, impacting transaction times and, potentially, causing financial complications for all parties involved.

- Security and Fraud Prevention

Payment processing relies on the accuracy of the RTN for enhanced security. Verifying the RTN is a key step in the process that mitigates fraudulent activities. Incorrect or falsified RTNs are easily flagged and can initiate security protocols. This verification is crucial for maintaining the integrity of the financial system. Accurate RTN handling helps prevent unauthorized transfers and safeguards against potential losses from fraud. An accurate RTN is a vital security protocol in modern payments.

- Automated Clearing House (ACH) Integration

The RTN is indispensable for transactions processed through the Automated Clearing House (ACH) network. The ACH network uses the RTN as a fundamental identifier to route payments effectively. It allows for high-volume transactions to be handled efficiently and accurately. The RTN facilitates the automatic routing of payments, contributing significantly to the speed and efficiency of the ACH network. This automation streamlines the process and is integral to payment processing efficiency.

In summary, the Routing Transit Number (RTN) is inextricably linked to payment processing. From identifying the recipient to routing funds efficiently and ensuring security, the RTN underpins the reliability and success of modern financial transactions. The RTN's role, therefore, is not just about identifying institutions but is fundamental to the seamless and secure operation of the entire payment processing system. The RTN's influence is paramount in modern finance, ensuring the timely and accurate handling of payments.

6. Error Prevention

Accurate routing of funds is paramount in the financial system. The Routing Transit Number (RTN) plays a pivotal role in preventing errors. An incorrect or invalid RTN can lead to significant consequences, from misdirected payments to financial losses. The system's reliance on the RTN's accuracy underscores its importance in error prevention. Incorrect RTNs lead to payment failures or, worse, the redirection of funds to unintended accounts. This failure can have far-reaching consequences, impacting both individuals and organizations. For instance, a payroll disbursement routed to the wrong bank account can cause substantial financial hardship for employees. Similarly, a misdirected corporate payment can disrupt business operations. Errors stemming from an invalid RTN can be traced directly to the fundamental weakness in the transaction process.

The significance of error prevention in the context of RTNs extends beyond individual transactions. In a large-scale payment system, errors can ripple through the network, leading to systemic issues. The potential for financial loss associated with misrouted payments is substantial. Ensuring accuracy in RTNs is therefore critical for maintaining the stability and integrity of the financial system. Robust validation mechanisms are crucial for verifying the legitimacy of an RTN, confirming its linkage to the appropriate institution. Rigorous checks and balances, supported by robust data verification procedures, mitigate the risk of errors and associated losses. Real-time monitoring and quick remediation of errors are key strategies in minimizing potential damages from inaccurate RTNs.

In conclusion, error prevention is intrinsically tied to the use of the Routing Transit Number. The accuracy and reliability of the RTN are critical components for safeguarding the financial system. Careful validation and verification procedures are crucial to minimize misrouted payments and the associated financial consequences. The ability to quickly identify and correct errors is essential for preventing significant financial disruptions within the network. Effective error prevention measures directly enhance the overall efficiency, security, and reliability of the payment system. This precision safeguards against errors that can cascade through the entire financial system, from individual accounts to large-scale institutions.

7. Automated Transfer

Automated transfer systems rely heavily on the Routing Transit Number (RTN). The RTN is a crucial component in the seamless and efficient processing of automated financial transactions. Understanding the connection illuminates the underlying infrastructure responsible for the rapid transfer of funds. This connection is critical for secure, reliable, and high-volume transactions within the financial system.

- Identification and Routing Precision

The RTN precisely identifies the receiving financial institution, ensuring funds are directed to the correct entity. This accuracy is essential for automated transfer. Without the RTN, the system lacks the precise method for identifying the destination bank, resulting in potential misrouting, payment delays, and financial losses. This facet highlights the RTN's fundamental role in guiding funds through the automated network, enabling efficient transfer.

- High-Volume Transaction Efficiency

Automated transfer systems routinely process high volumes of transactions, such as payroll deposits or bill payments. The RTN, in this context, allows for swift and accurate routing of these transactions. This efficiency minimizes delays and maximizes throughput in the payment processing network. The RTN, by providing a standardized identifier, is a key element facilitating the handling of large-scale automated transfers.

- Security and Fraud Mitigation

The RTN's function in automated transfers enhances security. By accurately identifying the recipient institution, the system minimizes the risk of fraudulent activity. Mismatched RTNs are easily detected, triggering alerts and security protocols. The RTN contributes to the security of automated funds transfer by providing an essential verification step.

- System Integration and Interoperability

The consistent use of the RTN enables different financial institutions and payment systems to communicate and transfer funds efficiently. Interoperability relies on the standard structure defined by the RTN. This standardized identifier allows diverse systems to share information, facilitating the automated movement of funds between various entities. The RTN facilitates smooth operations across various payment platforms involved in automated transfers.

In summary, the Routing Transit Number is integral to automated transfer systems. Its role encompasses identifying the receiver, streamlining high-volume transactions, mitigating fraud, and enabling interoperability. The RTN's accuracy and standardization are crucial for the reliability and integrity of automated financial transactions. This highlights the RTN's vital role in the modern financial landscape, enabling the efficient and secure automated movement of funds.

Frequently Asked Questions about Routing Transit Numbers

This section addresses common questions about Routing Transit Numbers (RTNs), clarifying their purpose, use, and importance within the financial system.

Question 1: What is a Routing Transit Number (RTN)?

A Routing Transit Number (RTN) is a nine- or eight-digit number uniquely identifying a financial institution. It serves as a crucial component in the Automated Clearing House (ACH) network, guiding the routing of electronic payments between banks. This number ensures funds are sent to the correct financial institution and ultimately to the intended recipient's account.

Question 2: How is an RTN used in financial transactions?

The RTN is used in conjunction with an account number. When a payment is initiated, the sender's financial institution uses the receiver's RTN to route the transaction through the appropriate network channels. This ensures that the payment reaches the correct bank and the correct account. This process is essential for the efficiency and accuracy of electronic fund transfers.

Question 3: What is the role of an RTN in the ACH network?

Within the Automated Clearing House (ACH) network, the RTN is fundamental. It provides the critical link to direct electronic payments to the designated financial institution. This precise routing ensures that funds are processed quickly and reliably through the network's infrastructure. Errors in the RTN can disrupt transactions and delay payments.

Question 4: Why is accuracy in RTNs so critical?

Accuracy in RTNs is paramount to prevent misdirected payments. An incorrect RTN can lead to significant financial consequences, such as delays, rejected transactions, or even funds being sent to an unintended account. The financial system relies on the precision of RTNs for security and efficiency.

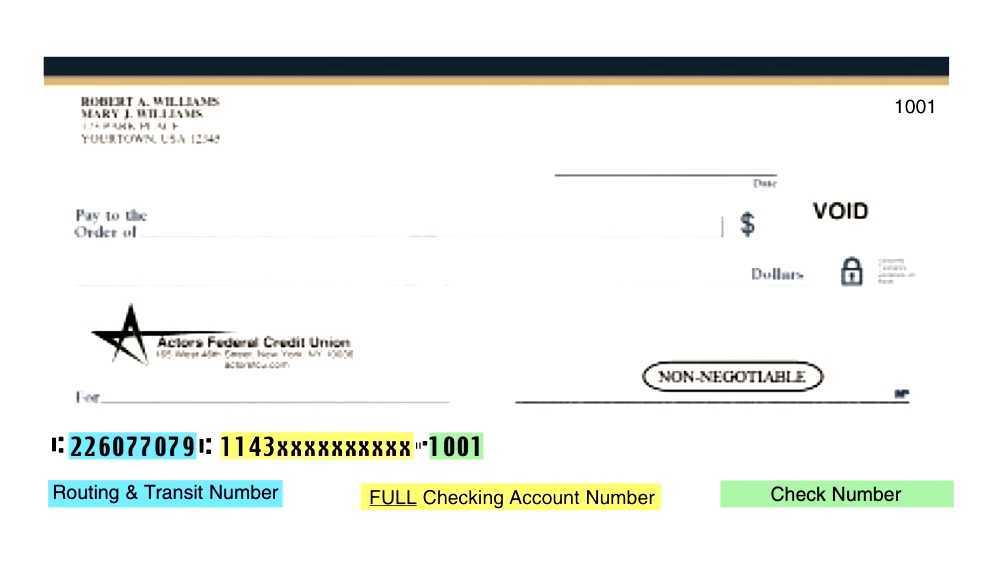

Question 5: How can I find my bank's RTN?

The RTN for a financial institution can typically be found on bank statements, checks, or by contacting the bank directly. Many banks also provide this information on their websites or online banking portals. Ensuring the accuracy of this identifier is critical for seamless financial transactions.

In summary, the Routing Transit Number is a fundamental component of the electronic payment system, ensuring the secure and efficient transfer of funds. Accurate identification and validation are crucial for reliable transactions. Understanding how RTNs operate enhances the understanding of modern financial processes and ensures proper operation within the financial infrastructure.

Further exploration of the ACH network and related payment processing systems would provide a more comprehensive understanding of financial transactions.

Conclusion

The Routing Transit Number (RTN) is a cornerstone of modern financial transactions. This nine- or eight-digit identifier serves as a critical link in the chain of electronic payments, ensuring funds are routed accurately and efficiently within the financial system. Its precise identification of financial institutions, coupled with its role in the Automated Clearing House (ACH) network, is essential for error-free and high-volume transactions. Key aspects explored include the RTN's function in transaction routing, its linkage to bank locations, its role in automated transfers, and its significance in error prevention. The RTN's inherent characteristics of uniqueness, coupled with its ability to facilitate high-volume processing, contribute to the reliability and security of the financial ecosystem.

The continued evolution of financial technology necessitates a robust understanding of the fundamental mechanisms that drive electronic transactions. The RTN, as a vital component of this infrastructure, remains crucial in modern finance. Failure to recognize the importance of accurate and secure RTNs could lead to significant financial disruptions and losses. Further advancements in payment systems and the emergence of new technologies necessitate ongoing vigilance and adaptability in the management and application of RTNs. A deeper comprehension of these mechanisms contributes significantly to the overall stability and security of the global financial system.

Article Recommendations